Free estate plan document templates created by Florida probate lawyers

Creating an estate plan can be confusing and intimidating. However, failing to plan can result in a legal mess for your loved ones when you die. No matter what you own, a good estate plan will help your family avoid red tape, expense, and stress when you pass away or become incapacitated. Beyond drafting estate plans, our law firm handles hundreds of probate cases every year, helping families transfer assets that belonged to deceased loved ones. We have seen firsthand what happens when people fail to plan for the inevitable. Having a plan will protect your family and give you peace of mind.

If you have already lost a loved one, and are usure how to handle their estate, click here for our probate guide. This publication, The Complete Guide to Florida Estate Planning, explains what steps Floridians can take during their lifetime to help their families in the event they pass away.

The best way to make an estate plan is to hire an experienced law firm to give you specific advice and to draft your estate planning documents. However, legal services are perceived as expensive, and many people forgo making an estate plan due to anticipated cost. Others neglect to plan due to confusion about what to do or even sign documents they don’t understand. The purpose of this guide is to educate and provide resources to Floridians with questions about estate planning. This guide represents our best practical advice for a general audience but is not a substitute for the services of a licensed attorney. Florida Probate Law Group assumes no responsibility for the use or misuse of this free information. If you would like to hire a law firm to draft your estate plan anywhere in Florida, contact us today by calling 352-354-2654 or clicking here.

This Complete Guide to Florida Estate Planning in 2023 will 1) explain what you need to think about when it comes to planning, 2) lay out a simple plan that can avoid probate for most estates, and 3) provide free forms to help you execute that plan. Prior to using the free resources included in this guide, it is necessary that you read the guide in its entirety. Using the forms without understanding the applicable law can lead to mistakes in your estate plan.

The following resources are included in this guide:

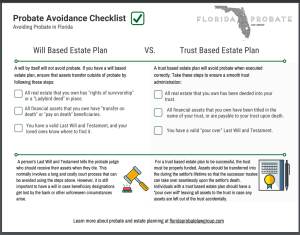

- Free Florida 2023 Probate Avoidance Checklist;

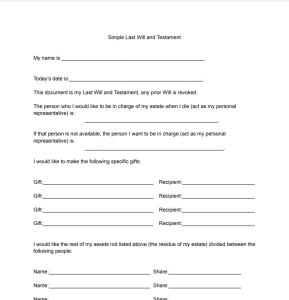

- Free DIY Florida 2023 Last Will and Testament;

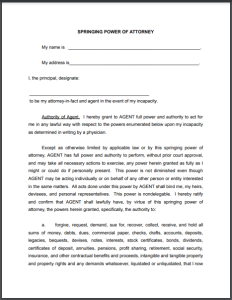

- Free DIY Florida 2023 Power of Attorney (POA);

- Free DIY Florida 2023 Health Care Surrogate (HCS);

- Free DIY Florida 2023 Living Will;

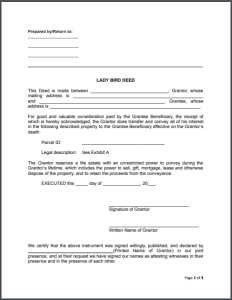

- Free DIY Florida 2023 Ladybird Deed.

Whether you are creating your own estate plan or hiring a lawyer to draft your documents, understanding the purpose of each document is critical to making sure that your wishes are carried out in the event of your death. Below, we will break down what each estate planning document does, why you need one, and what you need to consider when making your plan. Before using these free forms, it is important to read the entire guide so that you can understand how the forms work in the context of an estate plan.

Table of Contents:

- Estate Planning Definitions

- What is an Estate Plan?

- What is Probate?

- What is a Valid Will in Florida?

- Avoiding Probate in Florida

- Trust Based Estate Plans

- Free 2023 Florida Probate Avoidance Checklist

- Free Florida 2023 Last Will and Testament

- Homestead Property in Florida

- Transferring Real Estate in Florida – What is a Ladybird Deed?

- Free Florida 2023 Ladybird Deed

- Planning for Incapacity

- Free Florida 2023 Springing Power of Attorney

- Free Florida 2023 Health Care Surrogate

- Free Florida 2023 Living Will

- Estate Planning for Married Couples

- Estate Planning for Blended Families

- Estate Planning for Minor Children

- Estate Planning for Single Parents

- Estate Planning for Disabled Beneficiaries

- Florida Special Needs Trusts in 2023

- Life Insurance and Disability Insurance

- Why Hire an Estate Planning Lawyer?

1. Estate Planning Definitions

Estate Planning Definitions:

| “Decedent” | A person who died. |

| “Estate” | The assets of a decedent. |

| “Asset” | Anything with value. |

| “Will” or “Last Will and Testament” | A document directing what will happen to a person’s assets upon death and who will be in charge. |

| “Devise” | A gift made in a will. |

| “Intestate Succession” | The method of dividing an estate among next of kin in the absence of a will. |

| “Living Will” | A document that states medical wishes (do not resuscitate, etc.). |

| “Deed” | A document that transfers real estate. |

| “Power of Attorney” | A document that empowers one person to act for another. |

| “Health Care Surrogate” | A document that empowers one person to make specific medical decisions for another. |

| “Trust” | An instrument which can own property, controlled by a trustee. |

| “Probate” | The court supervised process of transferring a decedent’s estate to living people. |

| “Guardianship” | The legal process of gaining authority over a person or a person’s property. |

2. What is an Estate Plan?

An estate plan is a set of legal documents that tells people what should happen in the event of your death or incapacity and provides for the transfer of your assets to those you wish to receive them. The most commonly known estate planning document is a “Last Will and Testament.” A Last Will and Testament tells the world what should happen to your money, land, and other belongings after you die. Other estate planning documents include powers of attorney, trusts, health care surrogates, deeds, and pre-need guardianship designations.

These documents work together to help your family manage your affairs and transfer property if something happens to you. The best estate plans avoid “probate.” Probate is typically required to transfer assets and pay creditors after someone dies. A thoughtful estate plan will avoid probate court and make it easy for your family to take control of assets without the need to pay a probate lawyer or appear before a judge.

Having a Last Will and Testament by itself will not avoid the need for probate. Instead, your Last Will and Testament tells the probate judge who should inherit your assets and who should be in charge of your estate. This guide will explain what additional steps you can take to avoid the need for probate by having assets transfer automatically at the time of your death.

3. What is Probate?

Probate is the court supervised process of transferring the assets of a deceased person to living people. Those assets, including real estate, bank accounts, and personal property will pass to the decedent’s next of kin unless the decedent had a Last Will and Testament. The legal hierarchy of inheritance among kin in the absence of a will is called “intestate succession.” Our intestate succession flowchart, available below, breaks down how property is divided when the decedent did not have a will:

Intestate Succession Flowchart:

Provide your email address in the form below below to receive our intestate succession flowchart:

Intestate succession can be avoided by having a Last Will and Testament that directs assets to be distributed in a specific way. However, even with a Last Will and Testament in place a decedent’s assets must still pass through probate administration before being received by living people, subjecting those assets to creditor’s claims and causing an expensive delay for the beneficiaries of the estate. Creating a will is an important step in estate planning, but additional steps are required to keep your family out of probate court.

To learn more about the probate process in Florida, see our Complete Guide to Florida Probate.

4. What is a Valid Will in Florida?

In Florida, a valid will is any written document stating your final wishes signed by yourself and two witnesses. There are no specific words that you need to write to create an effective will. The most important elements of a will are 1) your signature, 2) contemporaneous witness signatures, and 3) an accurate description of your wishes regarding your assets that are subject to probate.

One important aspect of a will is that it names a personal representative to manage your affairs after death. Personal representatives are sometimes needed even when no assets are passing through probate. Specifically, if you were killed in a car accident or through another form of negligence, the personal representative named in your will is the party that has the right to sue on behalf of your estate and for the benefit of your family. Furthermore, your will can contain instructions regarding your burial and funeral services. These instructions provide guidance and comfort to your family in knowing that they are carrying out your wishes.

A gift written in a will is called a “devise.” Under Florida law, there are certain rules regarding what can be devised in a will. If a decedent had a wife or minor children, there are limitations regarding how they can devise their “homestead property” (the house that they live in). Specifically, if you have a spouse or minor children, you cannot devise the house that you live in (your homestead property) except to your spouse and/or minor children pursuant to Florida Statute section 732.4015. Section 9 of this guide has additional information regarding homestead property in Florida. Florida law additionally prevents a spouse from being “written out” or “disinherited from the will of their husband or wife. Florida Statute section 732.2075 provides the spouse of a decedent with the right to take an “elective share” equal to 30% of the decedent’s estate.

While it is not necessary for a will to be notarized in Florida, a notarized will eliminates the need for a witness to confirm the legitimacy of the will to the probate court. For this reason, most Florida wills are notarized. A notarized will is called a “self proved will.” In section 8, you will find a template for a simple self proved will.

Ultimately, it will be up to the probate judge to “admit” your will if you have assets subject to probate. Wills can be challenged on the basis of fraud, incapacity, or undue influence, if someone believes that the will was procured through trickery or coercion. The resulting litigation can take years and cost tens of thousands of dollars. Avoiding potential litigation is another advantage to an estate plan which avoids probate court.

Even in uncontested cases the probate process costs thousands of dollars and takes several months to complete. During probate, anyone owed money by the decedent will have an opportunity to make a claim on eligible estate assets. By avoiding probate altogether with a thoughtful estate plan, you can direct where assets should go automatically upon your death, without delay or expense for the people receiving them.

5. Avoiding Probate in Florida

Probate can be avoided through careful planning. The crux of avoiding probate is ensuring that when you pass away there are no assets in your name that do not have some provision for automatic transfer. This can be achieved in a variety of ways, however the traditional method of probate avoidance is to utilize a trust based estate plan. A trust is the most powerful (and complex) estate planning tool. A trust can 1) protect assets used by your family, 2) create rules for how assets are used after your death, and 3) preserve government benefits for disabled beneficiaries. A trust based estate plan should not be drafted without professional guidance. Florida Probate Law Group has extensive experience drafting and administering trusts, and our firm is available to Floridians seeking trust based estate plans, click here to make an appointment.

Simple Probate Avoidance:

A trust is not the only way to avoid probate in Florida. A combination of pay on death accounts and “ladybird deeds” can keep the average Floridian from needing probate when they pass away. By ensuring that all assets have provisions for automatic transfer upon death, you can decide exactly where those assets will go, and avoid the need for your family to hire an attorney and go through the probate process.

The simplest part of this process is nominating pay on death (also known as transfer on death) beneficiaries for your bank accounts and other financial instruments. Bank accounts that have a joint account holder or a designated pay on death beneficiary pass automatically upon death, and are not probate assets. Therefore, if all of your financial accounts have beneficiaries listed, those beneficiaries will have immediate access to those funds upon your death. They will simply need to bring a death certificate to the bank in order to access your accounts. The only downsides to pay on death beneficiary designations are that they are not very flexible in terms of leaving specific gifts to multiple people in different amounts. Furthermore, it is possible for banks to lose records of pay on death beneficiary designations, subjecting assets to probate.

Ladybird deeds achieve the same result of an automatic transfer, but for real estate instead of bank accounts. By creating a ladybird deed for real estate, a landowner creates a “remainderman” who will automatically inherit the property upon the death of the landowner. Section 10 of this guide goes into detail about the mechanics of ladybird deeds, and Section 11 of this guide provides a free template for a ladybird deed.

Avoiding probate for motor vehicles in Florida:

For vehicles, the DMV will often transfer to a spouse or child named in the decedent’s will without court supervision. To transfer the car title after death without probate, your family will need:

- The original title, if available.

- The Application for Certificate of Title With/Without Registration

*(See form HSMV 82040).

- Payment for the title transfer fees:

-

- $75.25 for an electronic title.

- $77.75 for a paper title.

- ADD $2 per lien for any liens on the vehicle.

- Other commonly required documents include:

- A copy of the owner’s death certificate.

- A copy of the decedent’s will.

Depending on the county you live in, the process for transferring a vehicle this way in the wake of someone’s death without probate may prove difficult. To avoid the need to transfer a vehicle this manner, you can simply title your vehicle in your name plus the name of the person you wish to inherit your vehicle. The title should read: “[owners name] OR [inheritor’s name]”, to accomplish this.

These simple steps can keep many Floridians out of probate. A more complex method of avoiding probate is through the creation of a trust based estate plan, described in our next chapter.

6. Trust Based Estate Plans.

How does a trust work?

A trust is a legal entity that you can transfer property to, control during your lifetime, and use to direct the transfer of that property upon your death. Trust are flexible and diverse, offering benefits that include:

- The ability to control how money is spent after you die.

- The ability to control how property is used after you die.

- Protecting assets from creditors/potential future liability.

- Protecting assets from divorce.

- Preserving government benefits subject to asset thresholds.

- Avoiding Probate.

- Assuring confidentiality.

- Tax planning.

By using a trust based estate plan, you can place assets into a trust, use them normally during your lifetime, and assign a “successor trustee” who will take over upon your death. The successor trustee then carries out your wishes without court oversight. Those wishes can be very detailed with respect to who will benefit from your property, when that should happen, and under what circumstances.

Trusts are often considered tools of the rich, however, they can be useful to families from all walks of life depending on the situation. Specifically, “Supplemental Needs Trusts” or “Special Needs Trusts” can be crucial in getting the most out of government benefit programs helping disabled Floridians, such as Medicaid and SSI. Section 18 of this guide speaks specifically to the benefits of trust for disabled Floridians.

If drafted and administered correctly, a trust based estate plan will avoid probate, and offers the additional benefit of a “living document” that can carry out your wishes after you pass away. The “successor trustee” nominated by you takes control of all trust assets without the need for a court process, and follows the terms on the trust in using or distributing trust assets. They can do so by simply presenting your death certificate to any institution holding trust property. Because no court oversight is required, trust administrations are confidential. Probate administration is public and not confidential.

“Trust” is important in a trust based estate plan, as your successor trustee has broad powers which can potentially be abused. The trustee has a “fiduciary duty” to all trust beneficiaries and is governed by Florida’s Trust Code. The fiduciary duty means that the trustee must at all times act in the best interests of trust beneficiaries while administering the trust. If the trustee breaches their fiduciary duty to a beneficiary they may be sued pursuant to the trust code. During your own lifetime you are typically the trustee AND the beneficiary – so you could potentially sue yourself (not advised).

The increased flexibility and power that come with a trust based estate plan come at a cost, which is complexity. While trusts are useful, they are not always necessary. Furthermore, it is not advisable to create a trust without the guidance of an experienced law firm. If you are interested in hiring a law firm to draft a trust based estate plan, contact Florida Probate Law Group at 352-354-2654 or click here.

7. Free Florida 2023 Probate Avoidance Checklist

Provide your email address below to receive the Probate Avoidance Checklist:

8. Free Florida 2023 Last Will and Testament

Provide your email address below to receive the Last Will and Testament Template:

9. Homestead Property in Florida

Although the advice in this guide is designed to help you avoid probate, it is helpful to understand what would happen if your home did go through the probate process. A house that you own and live in is referred to as your “homestead” in Florida. Florida law provides special protection for your homestead property when passing through probate. To qualify for homestead protection, a residence within city limits must be no bigger than ½ acre. Outside of city limits, a homestead property may be up to 160 acres. Homestead property is protected from creditors when passing through probate. This means that estate creditors cannot assert a claim to homestead property through the probate process. While homestead is afforded special protections when passing through probate, it is better to avoid probate altogether.

Married couples generally will not need to probate their home upon the death of the first spouse. In most cases, a husband and wife will own property together as “tenants by the entirety.” In such a case, the property does not go through probate, but transfers automatically to the surviving spouse. To determine whether a property is held as “tenants by the entirety,” you need to look at the deed to the property. If a deed contains the words “as husband and wife,” or “as tenants by the entirety” the property will automatically transfer to the surviving spouse upon the death of one spouse. When a property is not held as tenants by the entirety, and has no provision for automatic transfer on death, it will have to go through the probate process to be titled in the names of the decedent’s family or the beneficiaries of the decedent’s will.

Homestead property that is subject to probate has limits regarding how it can be devised through a will. The spouse of a married decedent automatically receives a life estate (the right to live in the home for the rest of their life) in a homestead property owned by the deceased spouse when the homestead is passing through probate. The surviving spouse can alternatively elect to take a 50% interest in the home instead of a life estate. This election must take place within 6 months of the decedent’s death. Failure to make an election will result in the spouse receiving a life estate in the decedent’s homestead property.

In order to transfer homestead property during their lifetime, a married person’s spouse must sign the deed transferring the property, even if the spouse is not on the title to the home. This requirement also applies when adding rights of survivorship to homestead property or creating a ladybird deed for homestead property.

10. Automatically Transferring Real Estate in Florida – What is a Ladybird Deed?

Normally, if the owner of real estate dies, the real estate must be transferred through the probate process. Probate can be avoided by executing a “Ladybird deed” during the owner’s lifetime.

What is a deed?

When an owner is alive, Florida real estate is transferred from one party to another using a deed. A deed must identify the grantor(s) and grantee(s), contain the legal description for the property, and be signed by the grantor(s), two witnesses, and notarized. The grantor is the person giving an ownership interest and the grantee is the person receiving an ownership interest. The notary can act as your second witness, but must sign in the witness portion of the document in addition to the notary certificate. If the property is the homestead of the grantor, the grantor’s spouse must sign the deed even if they are not a co-owner of the property.

The most common types of deeds in Florida are “quit claim” deeds and “warranty deeds.” A quit claim deed is made with no guarantees of ownership from the grantor. These deeds are very simple and often used between family members. A warranty deed is used during the sale of real estate and contains a guarantee that the grantor owns marketable title and has legal standing to transfer the real estate to the grantee. A third type of deed can be used to create an automatic transfer of the property upon the owner’s death.

Ladybird Deeds – A tool for probate avoidance

A ladybird deed, or “enhanced life estate deed,” is a different type of deed that allows an owner to transfer their future interest in a piece of real estate while retaining all the rights they currently have in the property. Ladybird deeds can be used for any type of real estate in Florida, including homestead property. By using a ladybird deed, a living person can create an automatic transfer for their real estate upon death, without losing the right to live in and/or sell the property during their lifetime.

A ladybird deed is referred to as an “enhanced life estate” deed because a “life estate” is the right to use a piece of property for the duration of your life. If someone owns a normal life estate in a home, they have the right to live in the home but not sell it. A person who owns a life estate is called a “life tenant.” The instrument which creates a life estate will specify who receives the property upon the death of the life tenant; that person is called the “remainderman.”

A ladybird deed is “enhanced” beyond a normal life estate deed because the owner/grantor retains not merely the right to live on the property, but also the right to sell or transfer the property without the permission or compensation of the remainderman (the person who would automatically inherit the property upon the owner’s death). This makes ladybird deeds great tools for estate planning. By adding a beneficiary that will inherit the property automatically upon the death of the owner(s), probate can be avoided.

Creating a ladybird deed for your Florida home will not affect the home’s eligibility for homestead status when it comes to taxes. Furthermore, ladybird deeds are not viewed as a “completed gift” for tax purposes, meaning that the “tax basis” applicable to the property when it is inherited will be the value of the property upon your death. This “step up” in tax basis is an advantage to the person inheriting the home, because if they were to sell the home, the profit is calculated using the more recent value from the time of your death, instead of the value of the home at the time the ladybird deed was executed. This creates less taxable profit.

Ladybird deeds cannot be used to circumvent Florida’s limitations on the devise of homestead property. This means that if you have a spouse or minor children, you can only transfer your homestead to those family members upon your death. If you and your spouse own a homestead residence together, you can name a beneficiary to inherit your property upon the death of the last surviving spouse by signing a ladybird deed together.

The following section of this guide contains a free ladybird deed template. Deeds are technical documents that must meet specific criteria to be enforceable. If you would like Florida Probate Law Group to draft your Ladybird deed, call us at 352-354-2654 or contact us here.

11. Free Florida 2023 Ladybird Deed

Provide your email address below to receive the Ladybird deed template:

12. Planning for Incapacity

An often overlooked aspect of estate planning involves planning for incapacity. If you lose mental capacity through an accident, disease, or old age, your family can face significant obstacles in managing your affairs and arranging medical treatment on your behalf. By using a “power of attorney” you can allow a trusted family member or friend to manage your affairs in the event of incapacity. Three important documents for incapacity planning are 1) a springing power of attorney, 2) a health care surrogate, and 3) a living will. The following sections of this guide provide free templates for these documents, however, you should understand how they work before executing them.

Families are often left in a quandary when a loved one loses the ability to manage their own affairs. Without a power of attorney, an “incapacity guardianship” case must be filed before a friend or family member can secure authority to manage your affairs in the event you can no longer make decisions for yourself. Incapacity guardianship cases are complex legal proceedings costing thousands of dollars in attorney’s fees. Before guardianship is granted, a committee of medical professionals is appointed by the court to assess your capacity, and a neutral lawyer will interview your family to form an opinion regarding your best interests. The proposed guardian must pass background and credit checks to be considered by the court. Guardianship cases are often contested when family members cannot agree about who should be in charge. To learn more about the guardianship process in Florida, see our article here.

The cost and inconvenience of a guardianship case can be avoided by executing a power of attorney while you have mental capacity to do so. The power of attorney provided below is for a “springing power of attorney,” which only becomes effective if you are deemed incapacitated in writing by your physician. Therefore, this power of attorney does not become active until you lose the ability to care for yourself. A power of attorney can empower an “agent” to act on your behalf to manage your finances, sell property, and execute legal documents. For this reason, it is extremely important that you only grant power of attorney to a person that will not abuse their position in the event of your incapacity.

The free form power of attorney form below must be signed by two witnesses and notarized. It contains certain optional clauses which must be initialed if you wish to grant specific powers to the agent named in the power of attorney. The “principal” named in the document is the person who is giving power and the “agent” named in the document is the person who will receive power to act on behalf of the principal.

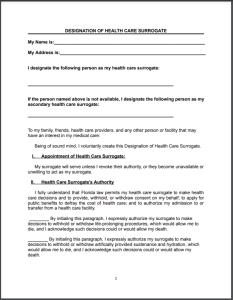

A health care surrogate is a document that grants another person the right to make health care decisions in the event of your incapacity, opposed to the financial matters covered by a power of attorney. In the absence of a health care surrogate, doctors and hospitals may not allow family members to have input into important treatment decisions. Medical providers will recognize the authority granted in a health care surrogate, and allow a designated surrogate to make decisions for you when you are incapacitated.

A living will is an important complement to a health care surrogate. A living will documents your preferences regarding health care, which are to be put into effect if you are incapacitated. Those preferences include whether you wish to be resuscitated and whether you wish to receive artificial nutrition if in a coma. Below, templates are provided for a springing power of attorney, health care surrogate, and living will.

13. Free Florida 2023 Springing Power of Attorney

Provide your email address below to receive the Springing Power of Attorney template:

14. Free Florida 2023 Health Care Surrogate

Provide your email address below to receive the Health Care Surrogate Template:

15. Free Florida 2023 Living Will

Provide your email address below to receive the Living Will template:

16. Estate Planning for Married Couples

Marriage has significant legal implications for many aspects of life including estate planning. A spousal relationship creates automatic rights for a surviving spouse when the first spouse dies. If a married person dies without a will in Florida, their spouse has the preference to act as personal representative of their estate. The surviving spouse will also be the sole “intestate” beneficiary (see section 3) unless one of the spouses had children from a prior relationship. Even when a married person creates a will to prevent intestate succession, the surviving spouse still has rights that override whatever is written in the will. Specifically, unless waived in a prenuptial agreement, the surviving spouse will always have rights to the homestead property (life estate or 50% ownership) and to 30% of the total value of the estate.

Furthermore any real estate owned by a married couple together as “tenants by the entirety” has built in rights of survivorship that will vest the full ownership of the property in the name of the surviving spouse upon the death of the first spouse.

While spouses are well protected under Florida law, many couples have specific wishes, such as to avoid probate, that can be achieved by an estate plan. Blended families, where one or both spouses have children from previous relationships benefit greatly from estate planning, because without an estate plan, children of the first deceased spouse may be unintentionally disinherited. The next section of this guide will discuss estate planning considerations for blended families.

17. Estate Planning for Blended Families

Both of the founders of Florida Probate Law Group come from blended families and our firm has worked with hundreds of such families either making estate plans or carrying out probate administration. Half siblings, step parents, and step children have limited rights under Florida intestate succession rules and are sometimes affected by intestate succession in ways that seem unfair.

A typical example of this involves a married couple that each have children from previous relationships. Many married couples keep joint assets that will all transfer upon death to the surviving spouse. Upon the death of the second spouse, only their blood relatives will have rights to their estate unless there is an estate plan in place. Therefore, the family of the spouse that died first may be deprived of an inheritance.

This accidental disinheritance can be avoided with a plan that will account for the couple’s blended family and each spouse’s wishes to provide an inheritance to their children regardless of who passes away first. Due to the complexities of estate planning for blended families and the legal considerations involved, we suggest contacting a lawyer when creating an estate plan for a blended family. Florida Probate Law Group is happy to help and available at 352-354-2654 or on our contact page.

18. Estate Planning for Minor Children

If you have minor children, your estate plan should contemplate who would care for those children in the event their parents were deceased. The tool to control who would be appointed as their guardian in that tragic circumstance is called a “pre-need guardianship designation.” The pre-need guardianship designation informs the court of your wishes regarding the care of your children, and grants the designated person(s) preference in appointment as their caretaker. This is a crucial part of your estate plan, because in the absence of a designation, your children may end up in the care of someone other than who you would prefer. Upon the death of both of a child’s parents, any family member may petition for guardianship, however, the person named in the pre-need guardianship designation will have preference of appointment. If you need a pre-need guardianship form, you should contact an experienced estate planning firm. Our law firm, Florida Probate Law Group, is available to assist if you need help.

19. Estate Planning for Single Parents

When a minor child’s parent dies, the surviving parent. becomes the child’s sole natural guardian. For single parents that are not in a positive co-parenting relationship, the prospect of a previously uninvolved or absent parent becoming the sole legal guardian of their child can be frightening. Unfortunately, a guardianship designation will not outweigh a biological parent’s right to care for the child, regardless of their previous relationship with the child. However there are certain planning steps a single parent can take to mitigate this issue. This is one situation where a trust based estate plan offers benefits that are unavailable through other methods of estate planning. A single parent can leave their child’s inheritance (including life insurance) to a trust, and choose someone other than the surviving biological parent to administer the trust. This third party trustee can be a trusted family member or friend who will use the money in the trust for the child’s benefit, so that the inheritance cannot be controlled by the child’s previously absent and potentially irresponsible surviving parent. A trust document to achieve this goal should be drafted by an experienced attorney. If you are interested in discussing a trust to hold your child’s inheritance, contact Florida Probate Law Group at 352-354-2654 or click here.

20. Estate Planning for Disabled Beneficiaries

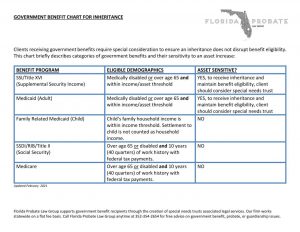

If you are leaving an inheritance to a disabled person, you must take special care not to jeopardize the government benefits that help them make ends meet. Furthermore, if your disabled relative has a guardian, it is important to consider a pre-need guardianship designation. As discussed earlier in this guide with respect to minor children, a pre-need guardianship designation is likewise an important tool for disabled individuals under guardianship.

Asset sensitive benefits such as SSI and Medicaid are canceled if the beneficiary puts too much money in the bank. In 2023, the asset threshold for these benefits in Florida is $2,000.00 for a single person and $3,000.00 for a married person. If the beneficiary puts more than that much money in the bank, they will lose their benefits. Our chart available below breaks down which categories of government benefits are asset sensitive:

Provide your email address below to receive the Government benefit asset sensitivity chart:

Losing the benefits that pay for medical care, housing, groceries, and other necessities can be devastating to a disabled person. Without careful planning, the well intended inheritance left to them can become more of a burden than a blessing. Fortunately, federal law provides disabled individuals with an option to receive and enjoy their inheritance without jeopardizing their benefits. Special needs trusts, discussed in the following section, can hold funds for disabled Floridians without affecting their eligibility for benefits.

21. Florida Special Needs Trusts in 2023

Fortunately federal law (42 U.S.C. § 1396p(d)(4)(A)) makes an exception to normal asset thresholds by defining a financial vehicle that can hold assets for a disabled person without jeopardizing their valuable government benefits. Known as a “special needs trust” or “supplemental needs trust” these instruments allow a disabled person to have an unlimited amount of money in their name without being disqualified from receiving benefits under asset sensitive programs.

In order to qualify for a special needs trust a person must meet the social security definition of disabled, meaning that they do not have the ability to work. A special needs trust can be funded by a family member for the benefit of a disabled relative or by the disabled person themselves. A trustee appointed in the trust document has the ability to spend trust funds for the benefit of the disabled person. The rules regulating trust spending are very liberal, and allow for trust funds to be used for any purpose except items already covered by government benefits. Therefore, items such as medications that would otherwise be paid for by benefit programs should not be purchased using trust funds. Trust funds are available to luxuries that would otherwise not be covered by existing benefits, such a travel, vehicles, dining out, etc.

For disabled individuals over 65 years old, a specific type of trust is required, referred to as a pooled trust. A pooled trust has the same advantages of a normal special needs trust, but is administered by a non-profit organization instead of a normal individual trustee. The non-profit organization administering the trust will work with the disabled client to ensure that the trust is compliant and that benefits are protected. The client/beneficiary can request funds from the organizational trustee, which are freely provided. Some non-profits provide debit cards linked to the trust account to make this process even smoother.

The disadvantage of a special needs trust is that upon the death of the disabled beneficiary, the government can make a claim on trust assets before those assets are inherited by that beneficiary’s family. The government’s claim can be up to the total amount of benefits paid to the beneficiary. Therefore, it is prudent to limit an inheritance left to a special needs trust to an amount that can be spent by the beneficiary during their lifetime, as anything left over at the time of their death may be subject to government liens.

Special needs trusts help many disabled people enjoy luxuries that are not provided for by government benefit programs. Leaving an inheritance to a special needs trust allows the disabled beneficiary to enjoy the best of both worlds by maintaining government benefits while simultaneously enjoying an inheritance. Special needs trusts should be prepared by a lawyer with knowledge of 42 U.S.C. § 1396 to ensure compliance with state and federal law. If you have questions about creating a Florida special needs trust, call Florida Probate Law Group at 352-354-2654 or click here to get in touch.

22. Life Insurance and Disability Insurance

Life insurance is an important part of estate planning, especially if you are a breadwinner for your household. The unexpected death of a financial provider can send a family into poverty overnight. Similarly, an accident or medical condition that prevents you from working can put your family’s future in peril. Life insurance and disability insurance offer affordable protection against these worst case scenarios.

Having handled hundreds of probate and guardianship cases and counseled families in the wake of tragedy, our attorneys have seen firsthand how life and disability insurance can help Floridians pick up the pieces after losing a loved one or suffering an unexpected disability.

Speaking to an insurance professional, or getting an online quote for insurance is fundamental to understanding your insurance options. Significant coverage can be purchased for a low monthly premium. Securing insurance coverage benefiting your family will give you peace of mind that they are protected. When choosing an insurance company to work with, it is a good idea to compare rates among several vendors, because rates may vary based on your age, medical history, and demographic information.

23. Why Hire an Estate Planning Lawyer?

If free forms are available, why would you pay an attorney to create your estate plan? There are several reasons. Attorneys can provide advice about the unique circumstances of your life, your assets, and your wishes for what should happen after you die. Knowing that an experienced attorney has reviewed your estate plan, and that you have the right plan in place, will provide peace of mind that your family is protected from probate and the associated headaches. Our law firm, Florida Probate Law Group, helps families across the state of Florida create estate plans that work. If you would like to hire Florida Probate Law Group to create your estate plan, click HERE to contact us or call 352-354-2654.

About our Firm

Florida Probate Law Group is proud to offer this Complete Guide to Florida Estate Planning in 2023. In handling hundreds of probate cases every year, our attorneys see firsthand the value in thoughtful planning before death. Having the opportunity to administer estates after people pass away gives us insight into the consequences of not having a plan. Creating an estate plan will give you and your family peace of mind that your wishes are known and will be carried out in the event of your death.

If you decide that you would prefer to hire an attorney to assist with your estate plan, we are happy to help with that as well. Our firm works statewide. Reach out to our office anytime at 352-354-2654 or click here to get in touch.

Click here to learn more about our firm.

Click here to see our Google reviews.

It is not necessary to hire an attorney to create an estate plan. It is necessary however to be confident in what you are signing and understand what is written in your estate plan. If you are not confident in your ability to use these forms correctly (or would simply prefer an expert to draft the forms) you should contact an estate planning attorney. Florida Probate Law Group is here for you if you wish to hire an attorney, and can be reached by clicking here or calling 352-354-2654.

Florida Probate Blog

Florida Probate Blog