- Free Consultation: (352) 354-2654 Tap Here To Call Us

The Complete Guide to Florida Probate – 2025

If you have lost a loved one, this Complete Guide to Florida Probate will help you understand the steps required to receive your inheritance. “Probate” is the legal process required to transfer property from a deceased person to the living people who are legally entitled to receive it. The 2025 Florida Probate Rules, documented here, determine who may receive inheritances in Florida. This guide explains the entire probate process in Florida including: (1) which assets are required to go through probate, (2) who is entitled to receive those assets, and (3) what steps are required to transfer those assets. To get answers to specific questions about your Florida probate case, click here, or call (352) 354-2654. Florida Probate Law Group handles cases in every Florida County and charges all inclusive flat fees for uncontested cases,

Table of Contents – The Complete Guide to Florida Probate

- What is Probate?

- What Property and Assets go Through Probate in Florida?

- Probate Jurisdiction in Florida

- Out of State Decedents and Ancillary Administration

- What is a Valid Will in Florida?

- What Happens When You Die in Florida Without a Will?

- Creditor’s Claims in Florida Probate Cases

- Exempt Property

- Homestead Property in Florida Probate

- Summary Administration

- Formal Administration

- Personal Representatives in Florida Probate

- What Does a Florida Probate Lawyer Do?

- How Much Does Probate Cost in Florida?

- How long Does Probate Take in Florida?

- Avoiding Probate in Florida

- What Happens to a Child’s Inheritance in Florida?

- Inheritances and Government Benefit Eligibility for Disabled Individuals

- Probate Litigation

- Florida Probate for Florida Wrongful Death Cases

What is Probate?

Probate, also called “estate administration,” is a court process that transfers assets owned by a deceased person to living people. When someone dies in Florida the things they own go to their family or, if they have a will, to the beneficiaries named in that document. In probate, the person who died is referred to as the “decedent.” Anything that the decedent owned when they died is collectively referred to as the “estate.” An estate can contain bank accounts, real estate, vehicles, guns, tools, jewelry, or any other item owned at the time of death. If a decedent had a valid will, that document directs who will be in charge of the probate process and who will receive the decedent’s assets upon their death. If a person did not have a will, their estate will be divided among their next of kin (the intestate heirs) as described in section 6 of this guide.

Probate is needed even when a decedent has a valid will. When someone dies with a will, a probate judge must “admit the will” to probate by finding that the will is valid, as described in section 5 of this guide. The probate judge can only transfer property according to the will after the estate is opened in court.

In legal terms, “beneficiaries” are people named in a will, and “heirs” are the next of kin who receive property in the absence of a will. Whether a decedent died with or without a will, the court’s priority is to ensure that the correct beneficiaries/heirs are identified to receive property.

There are two types of probate administration in Florida, formal administration and summary administration. Summary administration is a more simple process, while formal administration is required for certain estates that need the services of a personal representative or are too large for summary administration. The differences between these two types of probate proceedings are outlined in sections 10 and 11 of this guide.

When the beneficiaries or heirs of the decedent’s estate are identified and the correct probate documents are submitted to the court, the judge will sign orders allowing property to be transferred. Prior to property being distributed, the probate judge must be satisfied that all interested parties have received proper notice, that eligible estate creditors have been paid, and that any disputes among the beneficiaries are resolved.

Chapters 731-735 of the Florida Statutes contain the probate laws for our state, however each county in Florida has specific requirements that must be met before the probate court will allow a case to move forward. The Covid-19 pandemic changed the way that many probate courts operate, and most judges have transitioned to holding hearings by video conference. While the pandemic has ended, most Florida Judges continue to hold hearings via Zoom in the majority of their cases. Florida Probate Law Group has experience navigating the estate administration process in every Florida county in order to efficiently secure court orders.

What Property and Assets Go Through Probate in Florida?

Any asset owned by a decedent is subject to probate in Florida. The exception to this rule is property that had a named beneficiary or rights of survivorship. Examples of property that may have a named beneficiary would be a life insurance payout, a retirement account, or a bank account with a “pay on death” designation. An example of property with rights of survivorship would be real estate that has a deed indicating that a surviving co-owner will take the full ownership interest of the decedent upon their death. Property purchased by a husband and wife typically has rights of survivorship in Florida, even if that specific language does not appear on the deed to the property. This type of survivorship is called “tenancy by the entirety,” and only requires that title be held by husband and wife, in which case, title will automatically transfer to the survivor upon the death of one spouse.

If an asset does not have a named beneficiary or rights of survivorship, it will have to go through probate to change ownership pursuant to the Florida Probate Rules (2025). The most common assets that go through this process are bank accounts, real estate, vehicles, and personal property. In order to determine if a specific financial account is subject to probate, the financial institution should be contacted. In order to determine if real estate is subject to probate, an attorney should examine the deed to the property. Attorneys at Florida Probate Law Group provide free deed examinations, and can often retrieve deeds from the property records electronically. Call us at (352) 354-2654 if you have questions about property that may be subject to probate.

Probate Jurisdiction in Florida

The venue of a probate case is controlled by Florida Statute section 733.101. If a decedent was a Florida resident, their probate case must be filed in the county where they lived when they were alive. For an out of state resident, a probate case can be filed in a county where the decedent owned property. Probate cases are handled by circuit courts pursuant to Article V Section 20(3) of the Florida Constitution. Florida courts can only transfer property located within the state of Florida. Furthermore, a probate court only has jurisdiction over property that was owned by the decedent. However, a circuit court may freeze assets that are suspected to have belonged to the decedent until legal ownership is determined. Perez v. Lopez, 454 So. 2d 777 (Fla. 3d DCA 1984).

When completing probate in Florida, it is not typically necessary for clients to physically come to court. When hearings are necessary, clients can generally participate through video or telephone conference. If you have specific questions about a probate case in Florida, click here to get in touch with Florida Probate Law Group.

Out of State Decedents and Ancillary Administration

Because Florida is a popular state for vacations, many people own property here without being residents of the state. Furthermore, many people that move to Florida may continue to own property in the state where they are originally from.

For individuals that own property in multiple states, multiple probate administrations must be completed. In the state where the decedent lived, a “domiciliary” probate case will be filed. Next, an “ancillary” probate case is filed in the state where they owned property but were not a resident. Lawyers in each state will coordinate with each other to ensure that all of the decedent’s property is accounted for and legally transferred to their beneficiaries or heirs.

Ancillary probate administrations are common in Florida, and are governed by Florida Statute section 734.102. Florida Probate Law Group is experienced in multi-state probate administrations, and we are happy to answer any specific questions that you may have regarding this process. If you have questions about this Florida probate guide, call us at (352) 354-2654.

What is a Valid Will in Florida?

A will is a document that determines who receives a decedent’s property when they pass away. Florida law requires that a will must be signed by the testator (the person writing the will) and two witnesses to be enforceable. The testator must either sign in front of the witnesses or tell the witnesses that he or she previously signed the will. The witnesses must sign together in the presence of each other and in the presence of the testator. The rules for the execution of wills are found in Florida Statute 732.502.

It is not necessary for a will to be notarized for the document to be valid, however, notarized wills are preferred because they are easier to admit to probate court. A notarized will is referred to as a “self proved will.” When a will is not notarized, a witness to the will must make a statement to the probate court confirming that they witnessed the will. When a will is notarized, a witness statement is not required. Therefore, it is a best practice to have wills notarized whenever possible. The rules for self proved wills are found in Florida Statute 732.503.

If you need to create a will or submit a will to probate, call Florida Probate Law Group at (352) 354-2654. Our Gainesville, FL probate lawyers work in every Florida Jurisdiction.

What Happens When You Die in Florida Without a Will?

When a person dies without a will, their assets go to their spouse and/or closest relatives. Florida Statute sections 732.102 and 732.103 specifically determine how a decedent’s property is divided when they die without a will under the 2025 Florida Probate Rules. This process is referred to as intestate succession. Our flowchart below breaks down the intestate succession rules depending on what relatives the decedent left behind:

Download 2025 Intestate Succession Flowchart

To talk with a lawyer about the specifics of your probate case, click here. Our Gainesville, Florida based probate firm works in every Florida County.

Creditor’s Claims in Florida Probate Cases

Providing for the payment of creditors claims is part of the probate process. You should not pay debts of a decedent without consulting with a probate attorney, because not all debts are eligible for payment. Furthermore, you should never use your own money to pay the debts of a decedent. For decedents that died more than two years prior to their estate going through probate, no debts should will be paid because all claims are barred pursuant to Florida Statute section 733.710. The two year limitation on creditor’s claims does not apply to mortgages on real estate.

The process for handling estate debts is different depending on the type of probate administration you will be using. In a summary administration, all known debts are required to be paid from eligible, non-exempt assets of the decedent when those exist. The next section of this guide discusses which assets are exempt from creditors and which assets are available to creditors.

In a formal administration, creditors receive notice of the estate administration and must file claims in a timely manner in order to be eligible for repayment. A “notice to creditors” is filed in a newspaper in the county where the decedent lived, alerting potential creditors that they have 90 days to file a claim in the probate case to be eligible for repayment. Known creditors are sent a copy of that newspaper filing and given 30 days to file a claim. If a claim is not filed within the allotted time, the claim is waived. When claims are filed in a formal estate administration, the personal representative has the ability to object to the claim if they do not believe it is a valid debt. If a decedent had numerous creditors, formal administration can be beneficial in avoiding the payment of debtors who do not comply with the claim process. Florida Statute section 733.2121 sets out the rules for notices to creditors in formal administrations.

If you have questions about estate debts, call Florida Probate Law Group at (352) 354-2654.

Exempt Property

When a decedent has a spouse or children, some assets, including the decedent’s homestead property, two vehicles, household furnishings, and up to $1,000.00 in personal property are exempt from creditor’s claims and should not be used to pay debts. Florida Statute section 732.402 and Section 10, Article 4 of the Florida Constitution contain the rules for exempt property.

It is important that your attorney identifies exempt property to the court so that the probate judge understands that this property is not available to pay creditor’s claims.

Exempt property passes directly to the decedent’s wife and/or children and should never be used to pay debts of the estate. Non-exempt property is available to creditors who were owed money from the decedent. The most significant exemption under Florida law is for the decedent’s homestead property, which is covered in more detail in the next section.

Homestead Property in Florida Probate

Florida lawmakers have ensured that a decedent’s homestead (the house that they live in) is not taken by estate creditors upon their death. Decedents leaving their home to their wife, children, or descendants, are able to do so free of creditor’s claims. The exception to that rule is that “consensual liens” such as a mortgage on the property, tax debt, or money owed to contractors who performed work on the home may still be levied against a decedent’s homestead property.

Section 10, Article 4 of the Florida Constitution defines the requirements for property to qualify as protected homestead. Inside of city limits, a parcel of one half acre containing the primary residence owned by the decedent qualifies as protected homestead. Outside of city limits, homestead protection extends up to one hundred and sixty (160) acres of land containing the decedent’s primary residence. The purpose of this distinction is to protect farmers but prevent abuse of the homestead rule by person’s within the city limits.

In order to be considered a decedent’s primary residence, a decedent must reside in the home with the intention to make the property their permanent residence. There is no requirement regarding the amount of time that the decedent lived in the home prior to the home becoming homestead. Homes owned by companies and irrevocable trusts are ineligible for homestead protection, however a home owned by a revocable trust is eligible. Single family homes, condominiums, and mobile homes can all qualify for homestead protection. Even RVs and boats can qualify for homestead protection, but they must be immobile and fixed to the land (or a dock in the case of a boat).

In addition to the protections afforded to homestead property under Florida law, there are also restrictions regarding how a person can devise (give away in a will) their homestead in a will. If a person has a living spouse or minor children, they cannot leave their homestead to anyone except their spouse (which they can only do if there are no minor children). This limitation can be found in Florida Statute section 732.4015. If a decedent with a wife or minor children has a will improperly devising their homestead property, the property will pass as if there was no will.

There are differences between the way normal property passes under the intestate succession rules, and the way that homestead property passes. If a person dies with a spouse and minor children, the spouse receives a “life estate” in the home (the right to live there for the rest of their life). The “descendants in being” (the deceased person’s children, or if a child is deceased, their children) receive the “remainder interest” and receive title to the property upon the death of the spouse holding the life estate.

If the decedent did not have a spouse and minor children, interest in the homestead property will be transferred according to the intestate succession rules found in section 6 of this guide, unless devised to the spouse. If a decedent did not have a spouse, the homestead property may be devised to any person through a will, and in the absence of a will, the homestead property will be subject to the normal intestate succession rules.

For a quick visual guide to homestead, Kelley’s homestead paradigm is a tool used by many probate practitioners that graphically breaks down the homestead rules.

If you need to transfer a decedent’s homestead property, contact our firm today.

Summary Administration

Summary administration is faster, cheaper, and less involved than formal administration, and should generally be used whenever circumstances allow. In order to qualify for summary administration, an estate must contain less than $75,000 in non-exempt assets OR belong to a decedent that passed away more than two years ago.

In analyzing the $75,000 threshold for summary administration eligibility (which only applies to decedents which died within the last 2 years), exempt property is not counted. This means that if a decedent had a protected homestead property and two personal vehicles in addition to a bank account containing $74,000, the estate would qualify for summary administration, because the only non-exempt asset is worth less than $75,000. When a decedent passed away more than two years ago there is no limit on the value of the assets that can be transferred through summary administration.

The process of summary administration is more simple than that of formal administration, happens faster, and costs less money. A Petition for Summary Administration is filed with the court, and interested parties are provided formal notice of the proceeding via certified mail. Those parties include beneficiaries/heirs and known creditors, and in the case of unmarried decedents over the age of 55, the Agency for Health Care Administration. When those parties receive notice via certified mail, they have 20 days to object to the petition. Parties may elect to sign waivers agreeing to the probate proceeding, in which case the 20 day waiting period can be avoided.

Most counties additionally require an “affidavit of heirs” from the petitioner listing all relatives of the decedent. Some counties additionally require an “affidavit of criminal history.” When the court has received all required pleadings and is satisfied that the proper parties have received notice, the judge will issue an “Order of Summary Administration,” a legal document which officially transfers possession of the property of the decedent. The rules for summary estate administration are found in Chapter 35 of the Florida Statutes.

The downside of summary administration is that it cannot be used to probate large estates belonging to decedents who passed away within the last two years, and does not allow for the appointment of a personal representative to facilitate legal and business dealings on behalf of the estate.

If you need help with a summary estate administration in Florida, our attorneys will talk with you free of charge to discuss your options. Call us today at (352) 354-2654. Headquartered in Gainesville, FL, our lawyers work statewide, and are here to help you understand the Florida Probate Rules.

Formal Administration

Formal administration is the more involved variety of Florida probate. Formal administration is required for any estate with non-exempt assets valued at over $75,000 when a decedent died less than two years ago. Formal administration is also required any time that a personal representative is needed to settle the affairs of the decedent.

A personal representative (called an executor in other states) is a person appointed by the court to legally represent the estate. A personal representative can do anything the decedent could do when they were alive, and has a duty to ensure that the estate is distributed fairly to beneficiaries/heirs and creditors. Common scenarios when a personal representative is needed include when lawsuits must be filed on behalf of the estate, or when an investigation into the decedent’s assets must be completed. The specific duties and qualifications for personal representatives are detailed in the next section of this guide.

The first step in a formal probate administration is to seek the appointment of a personal representative. In order to have a personal representative appointed, interested parties must be noticed via certified mail. The rank of legal preference for personal representative is detailed in section 12 of this guide.

After a personal representative is appointed, an additional notice called a “Notice of Administration” is sent to interested parties letting them know that the decedent’s probate case has been opened.

Unlike a summary estate administration, a formal estate administration remains open while the decedent’s property is being collected, used to pay eligible debts, and then distributed to beneficiaries of a will or intestate heirs. As discussed in section 7 of this guide, formal administration includes a 90 day “notice to creditors” period that takes place during the case. Non-exempt assets cannot be distributed until the notice to creditors period is over.

In a formal estate administration, the personal representative is responsible for ensuring the legal transfer of the decedent’s assets to those entitled to receive them. The next section of our guide details who can serve as personal representative and the different tasks that they are responsible for during the estate administration.

Personal Representatives in Florida Probate

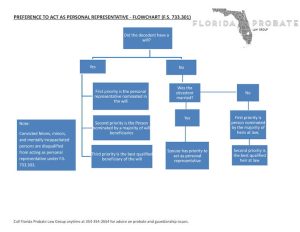

The first step in having a personal representative appointed is determining who may act as personal representative. If a decedent had a will, that document will state who has preference to serve as personal representative. If a decedent had no will, Florida Statute 733.301 determines who has preference to act. Our flowchart below breaks down the statute visually:

Download PR Preference Flowchart

The proposed personal representative will file a Petition for Administration with the Circuit Court having jurisdiction over the estate, and must also take an oath to lawfully administer the estate. If the personal representative is accepted, they are given “Letters of Administration” which give power over the estate.

Personal Representatives are sometimes required to pay a bond. This requirement can usually be waived when the personal representative is a family member.

Duties of the Personal Representative

These are the specific tasks that must be completed by the personal representative (with the help of their lawyer) during the estate administration:

Serve Notice of Administration Florida Statute section 733.212 requires the personal representative to mail a “Notice of Administration,” on interested parties, including the decedent’s spouse, beneficiaries, and others who may be entitled to estate assets.

Take Inventory

The personal representative has the job of collecting and establishing the value of all estate assets as provided by Florida Statute section 733.604. A copy of the inventory must be sent to interested parties and, upon request, a beneficiary/heir must also be provided a written explanation of how the value was determined, including copies of any appraisals if applicable.

Open Safe Deposit Box (If Needed)

There are specific requirements to open and take inventory of contents in a safe deposit box containing the property of the decedent. Florida Statute section 733.6065 sets out the process for taking inventory of a safe deposit box. The safe-deposit box must be opened in the presence of two of the following: (1) an employee of the institution where the box is located, (2) the personal representative, or (3) the personal representative’s attorney of record. Each person who is present must verify the contents of the box under penalties of perjury by signing a copy of the inventory.

Secure Property of the Decedent Florida Statute section 733.607 empowers the personal representative with control of the decedent’s property. The personal representative must act reasonably to protect and preserve assets for the benefit of interested parties during the estate administration. The personal representative will manage all estate property until creditors’ claims have been resolved and final distribution can be made.

Serve Notice to Creditors

As discussed in section 7, a personal representative must publish a notice to creditors under Florida Statute Section 733.2121, unless claims are barred (because a decedent died more than two years ago). The personal representative also must identify “reasonably ascertainable” creditors and provide the time frame for filing their claims for payment. If there are false debts alleged, the personal representative must challenge them by filing an objection.

Litigate on Behalf of the Estate

If the estate is being sued, or suing someone, the personal representative is responsible for managing that litigation. For instance, if someone needs to be sued for causing the decedent’s death, the personal representative must file a wrongful death action against the negligent party. Section 19 of this guide goes into detail about litigation involving the creation or administration of the estate, while section 20 discusses wrongful death litigation.

File Taxes When Required

If the estate produces income, or reaches the threshold to activate federal estate taxes the personal representative may have to file taxes on behalf of the estate. Florida does not have an estate tax or income tax, so the only taxes that can apply to a Florida estate are federal taxes. In 2025, the estate tax threshold for federal estate tax is $13.61 million per individual ($13,610,000.00), meaning that if a decedent has less than 13.61 million in assets there will be no estate tax. Therefore the vast majority of estates are not taxed.

If an estate remains open for an extended time and produces income through rental properties or investments, it may be subject to income tax. The income threshold for income taxes is six hundred dollars per year.

Florida Statute section 733.817 contains specific details regarding the apportionment of estate taxes in Florida, for those rare instances when they must be paid. When taxes are required to be paid in an estate, it is wise to involve a CPA who has experience in estate taxes.

Distribute Estate Assets

Once the personal representative has used estate assets to pay valid debts and estate administration expenses (including lawyers, storage, mortgages, etc.), final distribution can be made to beneficiaries/heirs. Distributions will be made through the payment of money or the transfer of property. If a bank account was created for the estate, the personal representative will write checks out of that account. If a law firm is holding estate assets in trust, the personal representative will authorize those to bi distributed. For land and other property, the personal representative will sign documents to transfer interest to the appropriate people. The personal representative may also take a fee of 3% of the estate assets for services rendered to the estate.

Close the Estate

Now that the personal representative has properly accounted for estate assets, paid valid creditors, resolved pending litigation, and distributed estate property to the appropriate beneficiaries or heirs, the estate may be closed. Florida Statute section 733.901 governs the discharge of the personal representative.

The duties of a personal representative are broad, and every probate case is unique. If you need advice regarding estate administration, call our office at (352) 354-2654 to schedule a free call with an attorney.

What Does a Florida Probate Lawyer Do?

Hiring the right probate lawyer can be the difference between a smooth estate administration and a nightmare. Ineffective counsel can exacerbate the already stressful process of resolving the affairs of a decedent.

Every lawyer’s job is to educate their client about the law that applies to their case, to present the case to the court, and to secure the best possible result under the applicable law. Most probate cases are uncontested, meaning that there is only one correct outcome under the law. Your probate lawyer’s first job is to understand Florida law and correctly determine who is entitled to the decedent’s assets. This is where many inexperienced attorneys make mistakes if they are not accustomed to analyzing estates using the Florida Statutes or interpreting the last will and testament in the context of an estate administration.

Once the correct beneficiaries and heirs are identified, the lawyer’s job is to draft the appropriate pleadings depending on state statutes and the local requirements of the county’s circuit court. The lawyer must then send the appropriate notices to interested parties before submitting proposed orders for the judge to sign. If anyone objects to the probate administration, the attorney must advocate on behalf of their client and explain to the court why the probate administration is proper. Specific examples of potential objections and probate litigation are outlined in section 19 of this guide.

If a lawyer makes mistakes at any of these steps, the probate administration will be compromised. Therefore it is extremely important to hire a firm that focuses their practice on probate, and has extensive experience handling estates. Our founding partner, R. Nadine David, worked in a Florida probate court as a staff attorney before entering private practice. Our policies and procedures for handling probate cases were built with an understanding of the court’s internal processes. Our understanding of the judge’s perspective allows us to secure results for clients efficiently. Click here to learn more about Florida Probate Law Group. Our Gainesville Florida, estate lawyers work in every county in the state.

How Much Does Probate Cost in Florida?

The cost of an estate administration will vary depending on the size and complexity of the estate. Our firm charges flat fees between $2,000 and $6000 for simple probate administrations in Florida. We charge flat fees when possible so that clients know exactly what the total cost of the case will be up front. However, due to the unpredictable nature of probate litigation and complex probate administrations, we charge hourly fees on those cases. Summary administration is less costly than formal administration, representing the lower end of the cost spectrum. Formal administration is a more involved process, and is typically more expensive.

Whenever hiring an attorney it is wise to retain a firm that focuses their practice to one area of law. Focusing on one practice area allows an attorney to become proficient and knowledgable over the course of their career. At Florida Probate Law Group, we focus exclusively on probate and estates.

In addition to attorney’s fees, there are court costs involved in estate administration. Filing fees between $345.00 and $405.00 must be paid for each case, unless waived for indigency. In formal administrations, there is also a cost of the publication of a notice to creditors in a newspaper, which is generally around $250.00.

Attorney’s fees and other estate expenses including funeral bills can be repaid to the person who paid them using estate assets.

If you would like to get a free quote and legal analysis of your probate case, call our firm at (352) 354-2654 to schedule a call with an attorney. Our attorneys, located in Gainesville, FL handle probate cases in every Florida county throughout the Sunshine State.

How Long Does Probate Take in Florida?

Summary estate administration generally takes around 8 weeks to complete in an uncontested case. This can vary depending on the law firm handling the case, the parties involved, and the court the case is filed in.

In a formal estate administration, it typically takes around 4-6 weeks to have the personal representative appointed. The estate generally remains open for around 1 year, however this will vary depending on what the personal representative needs to accomplish during the estate administration. For instance, if there is a wrongful death lawsuit arising from the decedent’s passing, the estate may need to remain open for multiple years before that lawsuit is resolved.

When beneficiaries argue about how an estate should be administered, these timelines are enlarged. Section 19 of this guide explains how litigation can affect the course of an estate administration. To get an idea of how long your specific probate matter would take to conclude, click here to contact our firm.

Avoiding Probate in Florida

Careful planning during your lifetime can allow your family to avoid probate upon your death. This allows assets to be available immediately free from creditor’s claims. Some tools for avoiding probate are simple and free, while others are more complex and require the help of an attorney.

Effective ways to avoid probate include:

- Pay on death beneficiaries of financial accounts

- By designating someone (or multiple people) to receive a financial account upon your death, you can avoid probate for that asset. Money from such an account will go directly to the beneficiaries listed on the account, bypassing probate. Pay on death beneficiaries can be added to financial accounts for free without the help of a lawyer.

- Lady Bird Deeds/ Rights of Survivorship. For real estate, creating a “Lady Bird Deed,” also called an enhanced life estate deed, will allow you to designate someone to receive a home or parcel of land upon your death. Similarly, “rights of survivorship” can be included in the language of a deed to allow a co-owner to have full ownership upon your death. When creating deeds, it is important to consult with an attorney. Florida Probate Law Group regularly drafts deeds to help families avoid probate for between $250.00-$350.00.

- Trust based estate plans. A trust based estate plan will avoid probate by placing your assets in a trust automatically transferred to a successor trustee upon your death. In your trust you will leave directions to your successor trustee regarding how your property should be divided. Trusts have advantages regarding asset protection to your heirs, privacy, and control of your assets after your death. To speak to an attorney regarding a trust based estate plan call our law firm at (352) 354-2654.

What Happens to a Child’s Inheritance in Florida?

Children’s inheritances are subject to specific laws to ensure that they are protected. Florida Statute section 744.301 provides that a child’s natural guardians may collect an inheritance up to $15,000.00 dollars for the minor. For an inheritance over $15,000.00 a guardian of the property should be appointed. That guardian may be one of the child’s parents or another responsible adult. The guardian must account for the child’s assets annually by filing documents with the court until the child turns 18. To learn more about the guardianship process, click here.

If you intend to leave property to a minor child, guardianship can be avoided through the use of a trust based estate plan. By naming the child as a trust beneficiary, you can allow a successor trustee to provide funds for the child as needed upon your death, until the child becomes an adult and receives their full inheritance.

Inheritances and Government Benefit Eligibility for Disabled Individuals

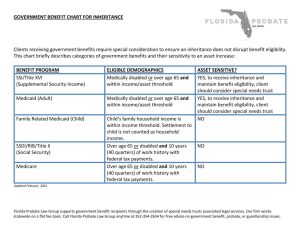

Many disabled individuals rely on government benefit programs to make ends meet. Certain programs, such as SSDI and Medicaid, are subject to asset thresholds. This means that if a person receiving government benefits puts enough money in the bank, they will lose their benefits. As of 2025, the asset threshold for SSDI and Medicaid in Florida is $2,000.00 for a single person and $3,000 for a married couple. Therefore, program recipients depositing more than this amount into their bank accounts are subject to a loss of benefits.

Our flow chart below illustrates which government benefits are asset sensitive:

Download Government Benefits Cheat Sheet 2025 – Inheritance

Asset thresholds are problematic for government benefit recipients who are receiving inheritances. SSI and Medicaid often provide thousands of dollars per month in medical care and financial assistance. Losing these benefits will result in the quick depletion of their inheritance. Fortunately, federal law (42 U.S.C. § 1396p(d)(4)(A)) allows for the creation of a “special needs trust” also known as a “supplemental needs trust” so that a disabled person can enjoy their inheritance without losing benefit eligibility.

By placing their inheritance in a special needs trust, a disabled person can access those funds for purposes like travel, dining out, vehicles, and purchasing consumer goods. Special needs trust funds are meant to supplement government benefits, and are therefore not supposed to be spent on medication, rent, or groceries. Special needs trusts provide flexibility for inheritance funds while allowing disabled individuals to remain eligible for government benefits, even when receiving large inheritances.

If you would like to discuss the suitability of a special needs trust for yourself or a loved one, call our law firm at (352) 354-2654.

Probate Litigation

When there are disagreements regarding an estate administration, lawyers will litigate in order to achieve their client’s goals. Most probate cases resolve without significant litigation. Litigation arises in circumstances when parties cannot agree regarding important aspects of the probate case, including 1) who should serve as personal representative, 2) whether a decedent’s will is valid, and 3) whether a personal representative has fairly apportioned assets of the estate.

Personal Representative Appointment Litigation

In determining who should serve as personal representative, a court will determine preference as indicated in section 12 of this guide. If two individuals have equal preference, they may serve as co-personal representative, or ask the court to determine which person is more qualified. In determining which party is more qualified, the court will consider criminal history, educational background, and the relationship with the decedent.

Contested Wills

If a decedent’s will is contested, the court will make a determination regarding the validity of the will after hearing arguments from all parties. Wills may be contested as technically deficient (lacking witness signatures), lack of testamentary capacity, or as being the product of fraud or undue influence. A fraudulent will would be a forged will or a will that the decedent was induced to sign through fraud.

There are two general categories of fraud for a Florida will:

- Fraud in the Execution: The decedent was led to believe the will they signed was some other document than a Will.

- Fraud in the Inducement: The decedent was intentionally misled about important matters that affected the decisions made in their will.

Undue influence is differentiated from fraud, and can be used to invalidate a will when the someone benefiting from the will had a confidential relationship with the decedent and procured the will for the decedent to sign.

Lack of testamentary capacity means that the decedent did not have full possession of their mental faculties when they signed the will. This could be caused by dementia, drugs, or other factors affecting their cognition.

Estate Administration Litigation

After a formal estate administration is commenced, if an heir or beneficiary believes that the personal representative is not fulfilling their duties, they may seek to have the personal representative removed. Grounds for removal would include the misappropriation of estate assets, or the failure to secure and protect property of the decedent. In some circumstances, the court will appoint an attorney ad litem to assist the personal representative in the proper administration of the estate as an alternative to removing the personal representative.

Florida Probate for Florida Wrongful Death Cases

When someone’s death is caused by negligence, the responsible party can be sued for “wrongful death.” In Florida, it is the responsibility of the personal representative to pursue the wrongful death claim on behalf of the estate. The personal representative will hire a plaintiff’s attorney to sue on behalf of the estate. The wrongful death claim is a separate case, filed in civil court. Florida Probate Law Group works with plaintiff’s firms and insurance carriers across the state to facilitate wrongful death estate administrations on a flat fee basis.

Wrongful death settlement proceeds are treated differently than other estate assets. Under Florida Statute section 768.21 explains who is eligible to receive damages for wrongful death in Florida. Our flowchart below breaks down who can receive wrongful death settlements:

Download 2025-Wrongful Death Damages Flowchart

In addition to bringing the wrongful death lawsuit, the personal representative is also responsible for allocating the settlement among eligible survivors. Damages due to survivors are not subject to estate creditors, and should never be used to pay debts of the decedent. Click here to learn about settlement apportionment in wrongful death cases.

About our Firm Florida Probate Law Group was founded by husband and wife Charles “Cary” David and R. Nadine David . Having worked in the courts and large law firms, our founding partners grew frustrated in watching ineffective lawyers take advantage of their clients by billing hourly rates for work that was unnecessary or counter productive. They founded Florida Probate Law Group with a vision of helping families and providing value for money. Now, our Gainesville, Florida based firm helps hundreds of families across the state with their legal matters every year. We strive to solve problems and help clients navigate the legal process painlessly and efficiently.

If you need advice regarding probate administration in Florida, click here to contact us or call Florida Probate Law Group anytime at (352) 354-2654 to schedule a free call with an attorney.

Our Gainesville, FL probate attorneys handle estate administrations in every Florida County, and are happy to speak with you about your case. We are proud to provide this Complete Guide to Florida Probate, and hope that it helps to explain the 2025 Florida Probate Rules.